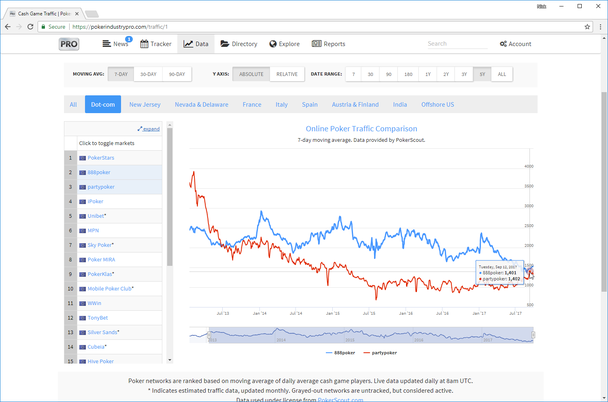

It may have only been for one day, but it was a historic one for partypoker: On September 12, partypoker’s seven-day moving average of concurrent cash game activity crossed the 1400 seats mark for the first time in over two and a half years.

It also moved above 888poker. The last time partypoker was larger than its European rival was on July 6, 2013—over four years ago.

Traffic Jam

Its lead was just by one seat, and it lasted only a day. As the attention from Powerfest faded, party’s traffic shrunk back down to around 1300 seats; 888, buoyed by its new promotion which focuses attention on its new Flopomania cash game, has bounced back over 1500.

Data provided by PokerScout

Data provided by PokerScout

But, while last month’s switch in position was brief, it underlines a broader trend at partypoker. As PRO discussed in detail last month, the operator is the only one to grow its liquidity in recent months; if this trend continues, the operator will solidify its position in the number 2 spot by the end of October.

As recently as last winter, it was battling with iPoker and MPN, hopping between the third and fifth spots in the European cash game traffic rankings. Go back to September 2015 and it was less than half the size of 888. Now it has more than the traffic of iPoker and MPN combined and is nipping at the heals of 888 to take the coveted second place spot.

Partypoker and its new owner GVC can take a lot of the credit, with a positive response to many core changes to the online poker vertical—improvements to its software, the online tournament schedule, its approach to ambassadors and a refreshed live tour presence all helping boost its profile and attract players.

It has also benefited from moves by its competitors. PokerStars has been open about its decision to disincentivize certain high volume activity on its site, reducing rewards to its biggest players in a bid to improve its player ecology long-term. 888 has also made a clear shift in its rewards and its approach to game design to encourage more recreational, casual play.

Opportunity

Partypoker’s growth has been, at least in part, opportunistic—it is attracting players that its competitors openly discourage. That point is made clear by its rewards program Cashback, a proud throwback in 2010-era loyalty programs that gives straight rakeback for high volume play. But some of its promotions too—like the grinder-favorite Gladiator—are not shy in coaxing over big players that may feel shunned on other sites.

In online poker, liquidity may be king, but it will be short-lived if the operator cannot build a sustainable ecosystem. Partypoker will need to build on this growth in liquidity to build a sustainable ecosystem that not only attracts high-volume, serious poker players but also the necessary number of casual players.

Partypoker has undertaken various initiatives that show it understands that liquidity alone will not be enough. It has already parlayed its increased traffic into greater goodwill among online poker players in forums and social media, thanks largely to an increased presence from its internal poker team, its external ambassadors and its social media stars (though effect on the mindsets of potential new and casual customers cannot be assumed).

The operator also realizes that it needs to attract recreational players in other ways; as party’s Head of Poker Tom Waters recently told PRO, it uses MTT overlays, ticket freebies and other changes to appeal to more casual players.

Its great strides in its live tour this year will also help. It successfully ran the largest event ever in Russia, one in a number of successes under its rejuvenated Live brand. Not only does this build brand loyalty among players and let it build a long-lasting online-to-live connection (something it has done to great success with its hybrid multi-day events), but it will also introduce its brand to live-first players.

Whether these efforts will pay off long term remains to be seen. But the operator is in this for the long-term; it appears to have the support within GVC now that executives can tout the explosive growth of its poker vertical to investors each quarter. It will certainly need a long-term outlook to realize its ambitions of returning to the glory days as the number one poker brand in the world.

This article originally appeared on Poker Industry PRO and has been republished here as a courtesy to our readers. Please visit Poker Industry PRO for more information on the industry intelligence services that are available, or email sales@pokerindustrypro.com to get a free trial.