- Zynga declined to offer specifics of user numbers for real-money gaming.

- Real-money gambling on Facebook and mobile platforms is scheduled to be rolled out in the 2nd half of 2013.

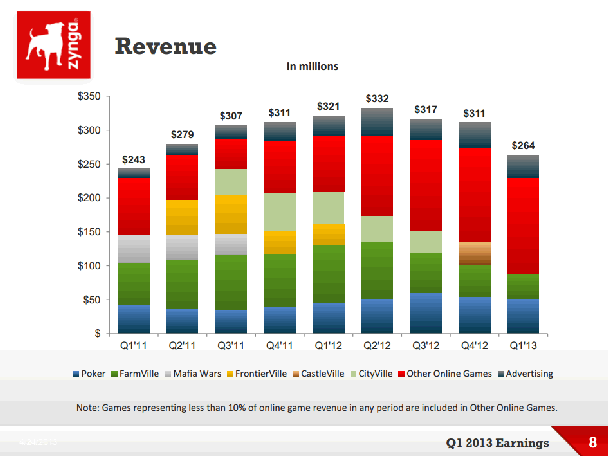

- Zynga Poker was responsible for 22% of total revenue in Q1 but was down slightly from Q4 2012.

- Zynga Poker did realize growth year-over-year, with a substantial bump from Q1 2012 to Q1 2013.

Zynga released information regarding the company’s performance for the first quarter of 2013 on Wednesday. The markets were unimpressed; following a 5% bump in the day leading up to the earnings announcement, after-hours traders immediately shaved nearly 10% off the stock’s price.

Partnership with bwin.party

Zynga launched real-money poker and casino skins of the bwin.party platform on April 2nd, 2013. The company declined to offer specifics of user numbers for or revenue generated by these games, but PokerScout data suggests the number of real-money poker players coming from Zynga to Party is negligible—so far.

CFO Mark Vranesh said Zynga is “expecting modest bookings from RMG” for 2013. But he hedged by saying that Zynga does not “believe they will be significant to 2013 results.” No further details regarding real-money performance were offered on the call.

Zynga Real-Money Plans for 2013 and Beyond

COO Dave Ko confirmed Zynga’s commitment to launching real-money gambling (RMG) on Facebook and mobile platforms in the 2nd half of 2013. Vranesh said Zynga is “on track” in Nevada.

On the question of US customers converting to RMG, Pincus said “We’re excited about the entire category of social casino [...] especially on mobile, where we’re seeing a very broad market for a range of products and a broad audience. On top of that there is the growth potential in the future to many of these same players […] when it’s possible.”

“There’s regulatory obstacles … that we can’t predict or control. And once we get to a point of offering it, it remains unproven as to what the take rate will be.”

As we’ve tested with our poker players, what they’re interested in, real money gaming is one of the highest testing new play opportunities that we’ve seen our player feedback tell us. We think it’s exciting from a player engagement standpoint … It eventually could be a very exciting business in the US.

Zynga RMG Outlook

Impressive mobile growth in Q1 2013 suggests Zynga is well-positioned—on at least one front—for a transition to real-money gaming in the US and abroad. This aspect of Zynga—which trails only Apple, Google and a handful of other companies in terms of total mobile use—is likely to become very attractive to a partner or suitor as US regulation shifts into launch phase.

One aspect of Zynga’s reporting that does not bode well for their real-money ambitions: Audience metrics.

The company reported audience levels that set new lows in terms of daily average uses (DAU) and skirted previous bottoms with monthly unique users (MUU). While above lows set back in 2011, monthly average users (MAU) dropped off substantially from preceding quarters.

Some of the loss can be attributed to the shuttering of several games in Q4 2012 and Q1 2013, and the relative lack of new product launches. But the larger picture suggests a shrinking Zynga player base, a problematic turn of events for a company counting on mass-market appeal to drive real-money gaming conversions.

Zynga Poker Performance in Q1 2013

Zynga Poker was responsible for 22% of total revenue in Q1. Revenue was down slightly from Q4 2012. But on the bright side, Zynga Poker enjoyed growth year-over-year, with a substantial bump from Q1 2012 to Q1 2013.

As mentioned above, Zynga does not break out revenue from its real-money online poker partnership with bwin.party. It appears that revenue reporting for Zynga Plus Poker and Zynga Plus Casino is included in “Other Online Games” and not “Poker.”

The Zynga Poker audience is made up of more international players than US players.

Zynga rolled out new leaderboards for poker in Q1 based on chips won. According to COO Dave Ko, this new feature drove increases in new buyers and per-user spend. Dampening that revenue growth in the poker product: An apparently substantial issue with fraudulent credit card purchases at Zynga Poker in Q1—significant enough that Ko warned of a drag on subsequent poker earning reports.