- US online poker revenue surged over 20% in May after PA joined multi-state poker.

- WSOP and BetMGM saw massive gains, with year-over-year growth of 50% or more.

- PokerStars lost market share after delaying its shared liquidity rollout, down 23%.

- Players benefit from more games and bigger tournaments across larger networks.

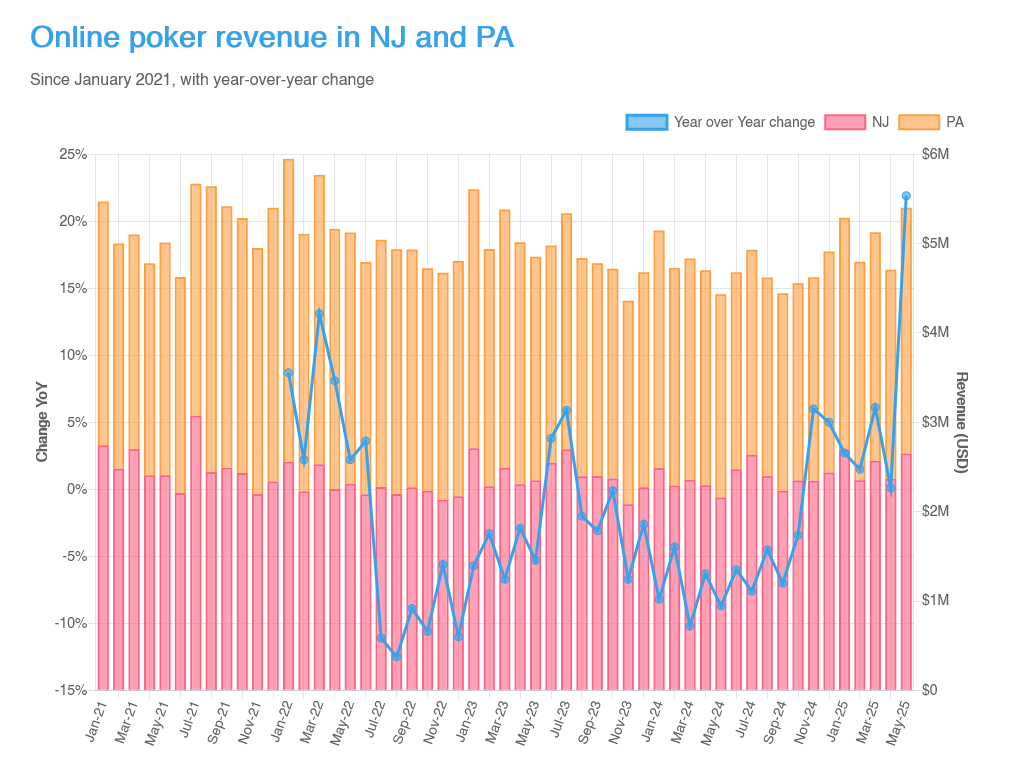

The impact of Pennsylvania joining multi-state online poker became crystal clear when May 2025 revenue figures were released. The regulated US online poker market grew by over 20% year-over-year, marking the highest single month of growth in recent memory.

The combined New Jersey and Pennsylvania markets generated $5.4 million in May 2025, up 22% from the same month a year ago. This represents only the second time in over three years that revenue reached this level.

New Jersey benefited most dramatically, posting 23% growth to reach $2.65 million. This was the state’s best growth month since February 2021 during the pandemic poker boom. Pennsylvania wasn’t far behind with 21% year-over-year growth to $2.75 million, achieving its best absolute revenue and growth in over three years.

The timing couldn’t have been more significant. PA online poker had been struggling with declining numbers before shared liquidity arrived, making this turnaround all the more impressive for players who had been dealing with smaller player pools and limited game selection.

Clear winners and losers emerge

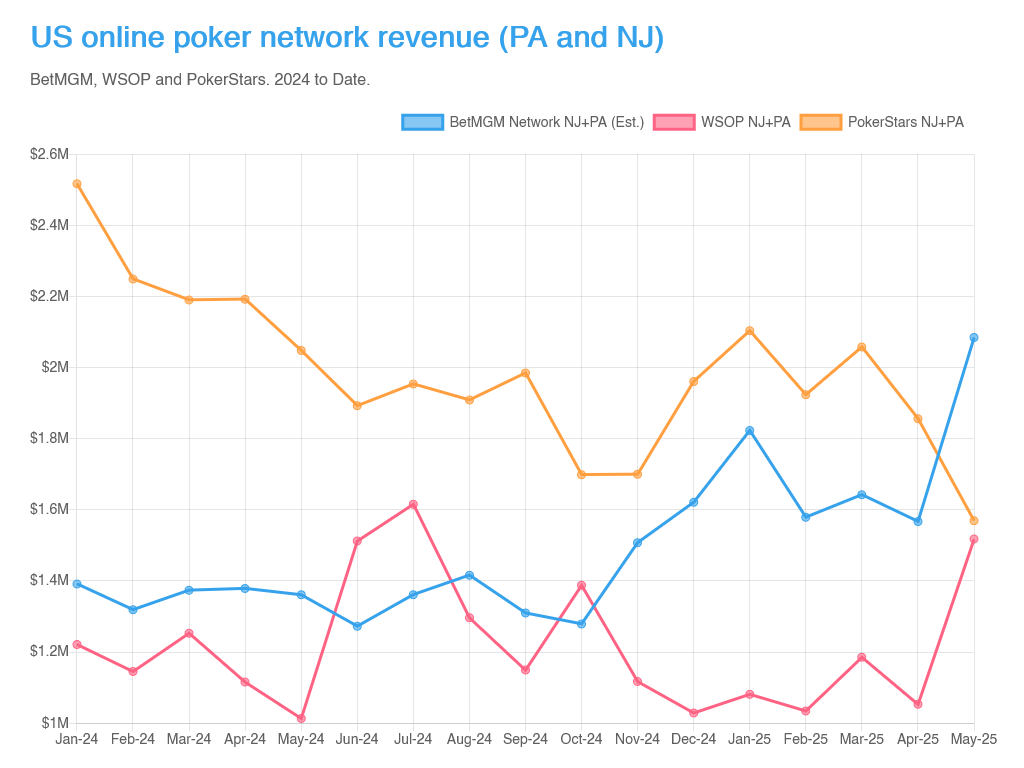

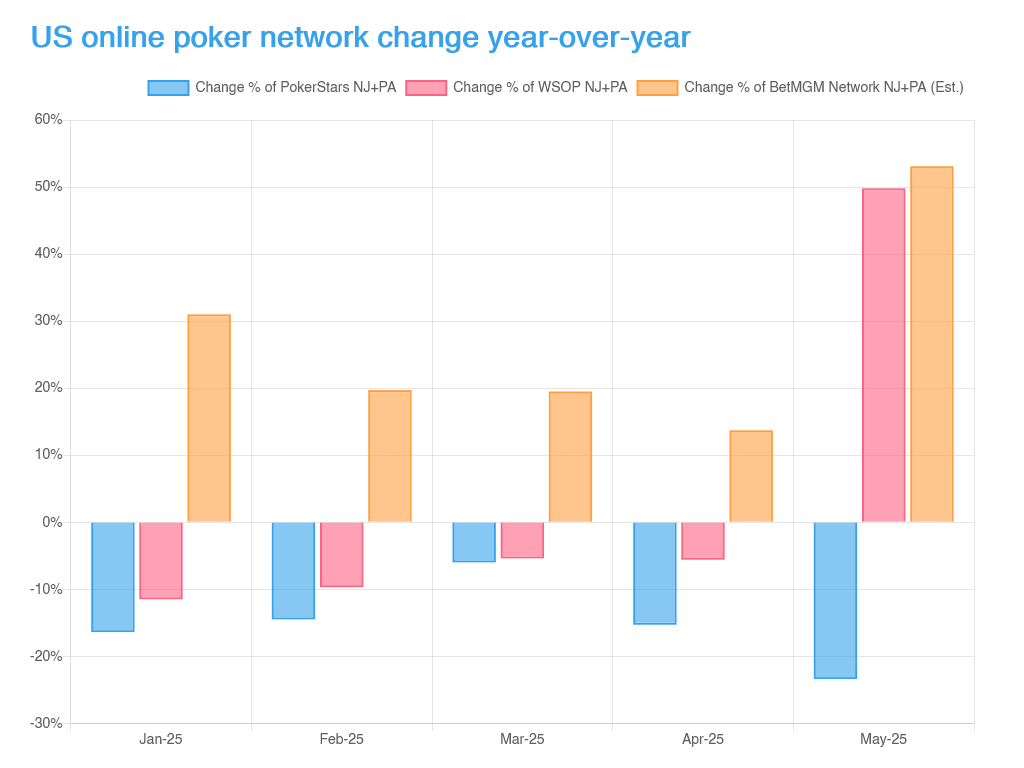

The revenue breakdown by operator networks reveals stark differences between those who embraced Pennsylvania shared liquidity and those who delayed it. The data shows clear winners and losers, with player preferences driving the results.

The WSOP Online network transformation was the most dramatic. Prior to Pennsylvania’s integration, WSOP had been in constant decline with revenue drops of 5% to 12% each month through April 2025. With shared liquidity in May, it jumped 50% year-over-year to over $1.5 million in revenue.

BetRivers Poker also capitalized on the shared liquidity opportunity. The BetMGM Poker network, which includes BetMGM Poker, Borgata Poker and PartyPoker across New Jersey and Pennsylvania, achieved approximately $2.1 million in revenue with nearly 50% year-over-year growth. This milestone put BetMGM above PokerStars for the very first time.

Meanwhile, PokerStars made the costly decision to postpone its Pennsylvania shared liquidity launch. This delay may be connected to a possible migration under the FanDuel brand, requiring re-licensing across multiple states.

The consequences were severe. While competitors grew 50%, PokerStars’ combined New Jersey and Pennsylvania revenue fell 23% to just $1.6 million. This represented the lowest month on record for Pennsylvania dating back five and a half years, and New Jersey’s weakest performance since February 2022.

What this means for online poker players

The transformation goes beyond simple revenue numbers. Players are experiencing tangible improvements in their online poker experience across participating networks.

Shared liquidity means larger tournament fields and bigger prize pools. Players who previously faced limited game selection during off-peak hours now find more active tables around the clock. The increased player pool also enables networks to spread higher stakes games more frequently.

The competitive pressure is driving innovation and better player experiences. Networks that failed to adapt quickly, like PokerStars, are losing market share to operators offering more comprehensive multi-state experiences.Looking ahead, the growth story isn’t finished. BetRivers expanded to four states in June 2025, creating another major network. Additional growth is expected as more operators join shared liquidity agreements and new states potentially enter the market.

The data proves that shared liquidity isn’t just beneficial for operators—it’s transformative for players. Bigger networks mean better games, larger tournaments, and more action. Players have clearly voted with their deposits, migrating from segregated sites to networks offering the full multi-state experience.

For US online poker players, Pennsylvania’s entry into shared liquidity represents a watershed moment that has fundamentally improved the online poker landscape. The numbers don’t lie: bigger is better when it comes to online poker networks.