Partypoker is reportedly up for sale. The question now is, who wants to buy it?

The online poker room’s current owner, Entain, is looking for a buyer after multiple sources told the gaming industry newsletter Earnings+More that partypoker is now considered to be a “non-core” asset. The story was cited by Steve Ruddock, a longtime poker and gaming industry writer and analyst, in his daily newsletter, Straight to the Point.

It’s a sad turn of events, but not a surprising one, for partypoker. Once the largest online poker room in the US, it left the states in 2006 when UIGEA went into effect. In a non-prosecution agreement with the DOJ, partypoker agreed to forfeit $105 million in April 2009.

Partypoker returned to New Jersey in November 2013, but hasn’t launched in another state since. It launched in Ontario when that market opened in April 2022.

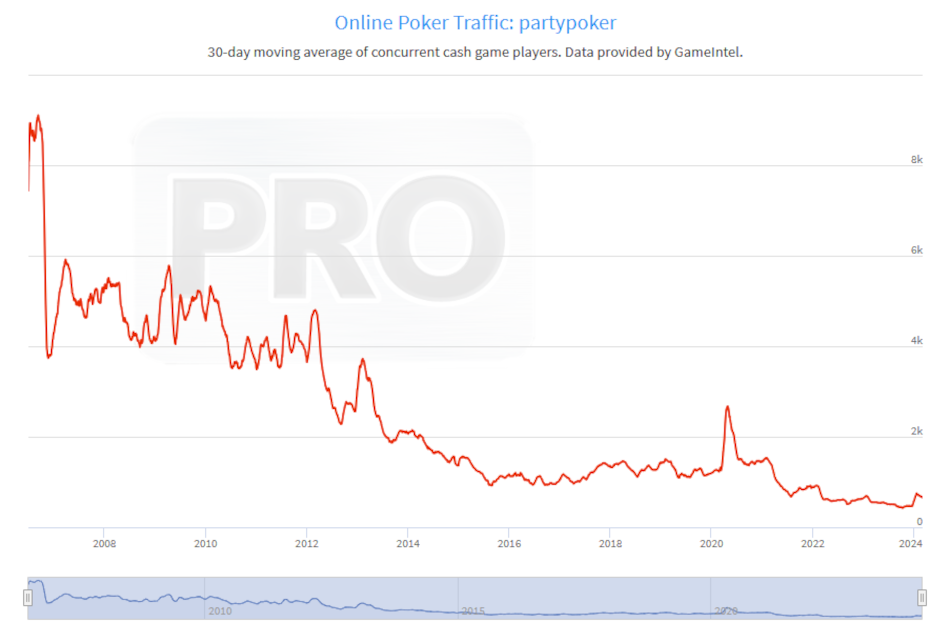

Things haven’t been much better globally for partypoker, either. Cash game traffic data from GameIntel shows the poker room peaked with a 30-day moving average of 9,102 concurrent cash game seats filled on September 10, 2006.

Three months later, partypoker was down to about 3,800 concurrent seats.

It’s been mostly downhill since. Partypoker fell below 2,000 concurrent cash game seats in April 2014 and never got above that mark again — except for a short stint between April and June 2020, at the height of the pandemic.

Global traffic on partypoker languished in the 400-range last fall, but rallied in mid-December and hit 750 concurrent cash game seats filled on January 19 before slipping into the 600-range. There were 660 seats filled on Sunday, the most recent day with figures available.

Other Brands Could Also Be Up For Sale

How much Entain could sell partypoker for remains to be seen, but it obviously won’t fetch top dollar. It was worth a lot more back in 2005, before UIGEA. Partypoker was valued at about £4.6 billion back in 2005, according to E+M, which equated to about $8.6 billion at the time. At one point it was worth nearly £10 billion.

One adviser told E+M that, besides partypoker, Entain would also be willing to part with some other brands from its portfolio, but that these brands “aren’t easily integrated” for a potential suitor. The brands include:

- Coral — a UK-based sportsbook

- Crystalbet — an igaming operator in Georgia (the European country)

- Enlabs — another igaming operator, this one in the Baltics (Estonia, Latvia, Lithuania)

- Eurobet — an online sportsbook owned by Coral

- Foxy Bingo — an online bingo platform in the UK

- Foxy Games — UK-based online casino

- SuperSport — an online casino and sportsbook in Croatia

MGM Resorts, DraftKings On Short List of Potential Buyers

Although another adviser reportedly told E+M that it was “hard to identify a natural buyer” for partypoker, two potential suitors stand out, albeit for different reasons — MGM Resorts International and DraftKings.

For MGM, it would be an opportunity to acquire the online poker tech that powers party and other Entain brands like bwin. It also powers BetMGM Poker, a 50/50 joint venture with Entain and one of the most popular online poker rooms in the US, alongside PokerStars and WSOP.

Whatever happens to party will likely impact BetMGM Poker in some form. Depending on who buys party, BetMGM Poker could:

- remain unchanged — the most likely scenario if MGM ultimately buys partypoker

- disappear altogether — a possibility, should one of MGM’s rivals acquire the tech and not be interested in a lease-back

- find a new supplier

- clinch a lease-back agreement from the eventual buyer, assuming it’s not MGM

Then there is DraftKings. Consider that the Boston-based company made a $22.5 billion cash-and-stock offer for all of Entain back in September 2021. One month earlier, they agreed to buy Golden Nugget Online Gaming (GNOG) in an all-stock deal valued at about $1.56 billion.

DraftKings tried to buy PointsBet’s assets in the US for $195 million in cash last summer, but the Australian-based company ultimately sold its operations to Fanatics instead for $225 million.

In short, DraftKings likes to buy things. It is not afraid of trying to buy things, either. So, whenever Entain gets around to putting a price tag on whatever assets it wants to sell, you should bet that DraftKings will be among those companies kicking the tires.

If DraftKings were to acquire partypoker, it would have the platform it needs to launch in Connecticut, a state where real money online poker is legal, but no operators are providing a peer-to-peer platform. DraftKings is partnered with the Mashantucket Pequot Tribal Nation, which owns and operates Foxwoods Resort Casino.

A sale of partypoker and any other assets could also increase the odds that MGM will take another bite at the apple and try again to acquire Entain. MGM tried to buy Entain for $11.1 billion back in January 2021.

MGM has long been interested in acquiring Entain. If it buys the UK-based company, it will have full control of BetMGM, the successful 50/50 joint venture MGM has with Entain.

Entain is scheduled to report its full-year earnings for FY 2023 on Thursday. It will be the first opportunity for the company to discuss its plans.