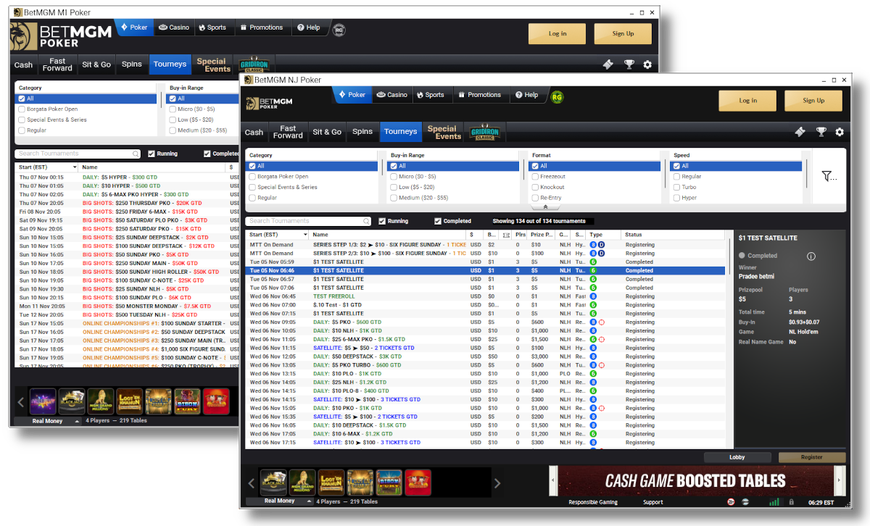

On Wednesday, November 6, BetMGM Poker combined its Michigan and New Jersey player pools to create a single shared liquidity network, making it the third network in the US to do so.

This represents a major milestone for both the BetMGM Poker US network and the US online poker landscape, bringing BetMGM onto equal footing with PokerStars US and WSOP Online—both of which have also connected their Michigan online poker sites with other states.

Shared liquidity has obvious benefits: it means more games running around the clock, a wider variety of options, bigger fields in tournaments and larger prize pools, and faster-filling Spins. We saw these advantages play out when PokerStars merged Michigan with New Jersey last year and when WSOP connected New Jersey with Nevada years ago and later added Michigan to the network this year.

- Up to $100 in tournament tickets on top of the bonus

- Frequent MTT series with good guarantees

- Combined player pools in Michigan and New Jersey

Terms & Conditions apply. Must be 21+. PA Only. All promotions are subject to qualification and eligibility requirements. Rewards issued as non-withdrawable site credit, unless otherwise provided in the applicable Terms. If you or someone you know has a Gambling Problem, help is available, Call 1-800-GAMBLER. In Partnership with Hollywood Casino Penn National Race Course.

Visit BetMGM.com for Terms and Conditions. Must be 21+. NJ only. New Customer Offer. All promotions are subject to qualification and eligibility requirements. Rewards issued as non-withdrawable site credit and/or tournament entries. Rewards subject to expiry. Gambling Problem? Call 1-800-GAMBLER.

Terms & Conditions apply. Must be 21+. MI Only. All promotions are subject to qualification and eligibility requirements. Rewards issued as non-withdrawable site credit, unless otherwise provided in the applicable Terms.

Bet With Your Head, Not Over It. Must be 21 or over and in Michigan to play. If you or someone you know has a gambling problem and wants help, call the MDHHS Gambling Disorder Help-line at 1-800-270-7117 or visit the MDHHS website.

So, what benefits does shared liquidity bring to BetMGM Poker?

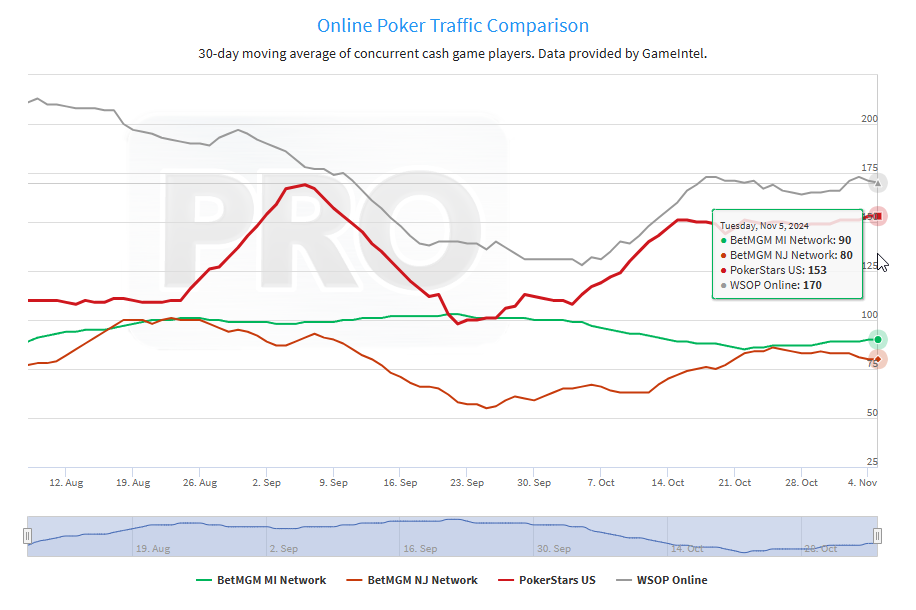

Based on data tracked by independent industry monitor GameIntel, provided exclusively under license to Poker Industry PRO, the merger of BetMGM’s New Jersey and Michigan player pools could make it the largest online poker network in the regulated US market.

Currently, BetMGM Poker Michigan averages around 90 concurrent cash game players, while BetMGM Poker New Jersey sees about 80, based on a 30-day moving average. Together, the combined BetMGM MI+NJ network would reach approximately 170 concurrent cash game players.

This player pool size would place BetMGM Poker on equal footing with WSOP Online, which averages around 170 cash game players, and above PokerStars USA, which averages about 150.

US Online Poker Traffic (Nov 2024)

| Network | 30-Day Traffic |

|---|---|

| WSOP Online (NV+NJ+MI) | 170 |

| PokerStars USA (NJ+MI) | 153 |

| BetMGM MI | 90 |

| BetMGM NJ | 80 |

| BetMGM NJ+MI (Combined) | 170+ (Expected) |

Importantly, this figure does not account for the network effects likely to emerge from combining player pools. With more games continuously available and larger tournament prize pools made possible by shared liquidity, BetMGM could see a compounding effect. Dormant players may return, and players from competitor sites with shared liquidity might be tempted to switch to BetMGM Poker.

A key consideration is that these estimates are based on current figures, which can fluctuate over time, as we have often seen before. WSOP typically dominates during the summer months when the live series is running, while PokerStars tends to perform stronger in the winter season.

But if we were to go by today’s figures, a combined BetMGM Michigan and New Jersey network would rank as the largest among all current networks. Official data will be available in a few days to confirm this.

Interestingly, even without shared liquidity, the BetMGM Poker network in NJ—including the trio of skins BetMGM, Borgata, and PartyPoker—currently leads the New Jersey online poker market in revenue. In September, these skins, operating under the Borgata license in NJ, reported $778k in revenue, slightly edging out WSOP at $752k and PokerStars at $703k.

A combined NJ and MI network would likely boost BetMGM’s revenues further, making it a powerful competitor. Although Michigan does not separate poker revenue from overall casino revenue, it is expected that BetMGM’s online poker revenue in the Great Lakes State would increase as well.

US Online Poker Future Looking Bright

Whether or not BetMGM Poker US becomes the largest network, this merger is a milestone event for online poker fans in Michigan and New Jersey. Meanwhile, Pennsylvania—the largest regulated online poker market in the US—is on track to become the sixth member of the Multi-State Internet Gaming Agreement (MSIGA). Last month, PA Governor Josh Shapiro directed the state regulator to take steps toward joining the compact.

Once Pennsylvania joins, BetMGM and other operators will be able to merge their PA player pool with those in MI and NJ. BetMGM also holds an interactive gaming license in Nevada and may go live before WSOP 2025, creating the possibility of a four-state shared liquidity network.

Additionally, BetMGM has the potential to expand online poker to West Virginia, where it already offers an online casino.

These developments signal a promising future for US-regulated online poker. For the first time, major operators are aligned in terms of shared liquidity. WSOP currently holds an advantage with its operations in Nevada, though the state’s impact is largely seasonal, benefiting most during the summer when Las Vegas hosts the WSOP bracelet events. However, with all three major networks now sharing liquidity between NJ and MI, competition is set to intensify.

Adding to the landscape, BetRivers recently entered the online poker scene, initially launching in Pennsylvania. BetRivers is expected to expand to other states and could establish a shared liquidity network across Delaware, New Jersey, and Michigan—all members of the interstate compact.

And let’s not forget DraftKings, which recently made its move into peer-to-peer poker with Electric Poker, a unique lottery sit-and-go product that introduces a fresh approach to the market. It is currently live in two states: Michigan and Pennsylvania.