New Jersey is an online poker battleground, with three licenses and six online poker rooms battling it out for their share of poker dollars. The last year has been a banner year for online poker operators around the globe, and New Jersey certainly was not left out of the rush.

Revenue for 2020 shot up like a rocket starting in March of last year, as the world went into lockdown from the COVID-19 pandemic. Operators everywhere saw a huge uptick in revenue as players were looking to find ways to spend their lock down time.

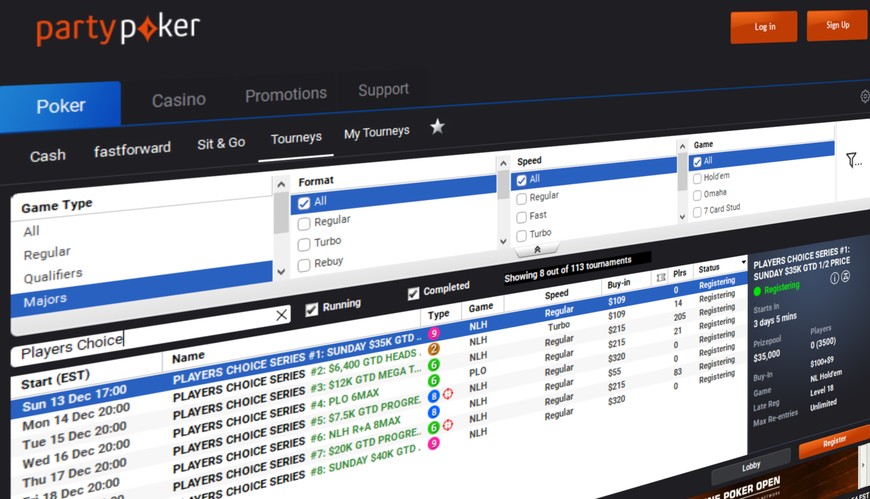

February 2020 was the last “normal” month in the pre-pandemic world, and with February 2021 still firmly inside the pandemic window, it is no surprise that revenue numbers are higher this year than last. The combined network of BetMGM USA, Borgata, and partypoker, collectively known as the partypoker US Network, saw the biggest year-over-year gains in February, booking a 75.3% revenue increase from the same month in 2020.

However, all operators enjoyed annual gains. The market overall was up 38% year-over-year, with a combined $2.5 million generated across the three licensees.

Revenue by the Numbers

It was a strong month across the board in New Jersey in February, though none of the operators managed to bank more than $1 million in revenue. Once again it was Caesars, represented by WSOP NJ running 888poker software, which took the biggest revenue haul and came closest to the $1 million figure in February, banking $955,318 in total revenue. It was also the only operator that was close to flat sequentially—the other two licensees saw a notable month-on-month dip.

Borgata, the license holder behind BetMGM and partypoker US Network, held on to their second place position in total revenue last month, booking nearly $800,000. That left PokerStars, licensed in New Jersey through Resorts Casino Hotel, at the bottom of the list with a respectable $728,945 total.

The raw numbers only tell part of the story. With barely $450,000 in revenue in February 2020, the Borgata group posted a year-over-year increase for February of more than 75%. That was miles ahead of the second place finisher, Resorts, whose $728,945 was about 37% higher than their February 2020 total.

In fact, despite posting the highest raw revenue figure for the jurisdiction in February, Caesars was the brand with the smallest year-over-year gains. That was down to a solid month last year when they posted more than $800,000 in revenue for February, almost $300,000 more than either competitor. So while Caesars posted a month with almost $1 million in revenue this year, they still ended up at the bottom of the year-over-year pile with a modest increase of less than 20%.

Still, the biggest story coming out of New Jersey lately is the overall improvement to the Borgata brands. While some of that is down to a lackluster previous year, where they failed to make more than $500,000 in any given month, the increase wins are not just by percentage. Borgata’s total revenue increase from February 2020 to 2021 was nearly $350,000, while their competitors didn’t even add $200,000 to their revenue totals from last year’s February.

The secondary story from New Jersey is the continued success of the Caesars group. Once again, in February 2021, they posted the most revenue of all three poker operators, a position they’ve held on to since June of last year. In fact, they have only missed that top spot once since May of 2018 when PokerStars briefly took the top spot in April of 2020. With the World Series of Poker season upcoming for Caesars in the next few months, they look set to hold onto that top revenue spot.

That leaves PokerStars, under the Resorts license, as the odd man out. They posted the smallest revenue numbers of any operator in February 2021. PokerStars NJ lost the second place revenue spot late in 2020 to the surging Borgata brands, and the trend seems to be continuing through early 2021.

It is a rare position for the global market leader to sit at the bottom of the pile. Apparently, all attention is on PokerStars Michigan and PokerStars Pennsylvania, where the operator is boasting osurging traffic and revenue figures.

Meanwhile, it seems unlikely anyone will unseat Caesars from the throne with the upcoming WSOP expected to play its online component on the network, the battle for second place is still an open question. That is until shared liquidity between New Jersey, Pennsylvania and Michigan is possible.