888, currently the largest online poker network in the US, seems to be taking a measured approach in Pennsylvania, the state that will soon be the most populated to offer poker over the internet.

In an exclusive interview with pokerfuse, Yaniv Sherman, 888’s Head of Commercial Development, stated that while Pennsylvania has the potential to be a “big online market,” 888 has “[n]o firm timeline for PA yet, but we’re working with our partners at Caesars in order to bring WSOP into PA as soon as we can.”

That cautious approach was reinforced by the company on Tuesday during a conference call to discuss its H1 financials for 2019, during which it referred to its strategy for entering new US states as being “Smart and Selective.”

Notably, Sherman did not mention the status of the 888poker brand coming to Pennsylvania, instead teasing a launch of the WSOP brand which operates under a B2B partnership with 888 on the All American Poker Network (AAPN). However, Sherman confirmed that the company still plans to continue offering its globally popular 888poker brand to consumers in the US.

Sherman also indicated that the recent flip-flop by the US Department of Justice on its interpretation of the Wire Act is a consideration that could impact how the company approaches new states that legalize and regulate online poker.

But with poker’s low customer acquisition cost and tax rate relative to other its other igaming verticals, it is clear that poker will continue to be an important part of the company’s overall strategy.

In fact, Sherman stated, “Our main goal is to help states who legalize online poker join the existing compact and network, as liquidity is the key component to any poker product,” a sentiment that was echoed to investors with Itai Pazner, CEO of 888 Holdings, declaring “Liquidity is king.”

You can read the full interview with Yaniv Sherman below, and the financial results are available on the 888 corporate website.

Pennsylvania is the latest of just a few states to launch online casino games and slots (with poker coming soon). How do you think the Pennsylvania market will differ from neighboring New Jersey and can we expect 888 to offer a full suite of online gaming in the state?

PA is definitely a potential big online market, being only one of a handful of states to offer both sports betting and iGaming. However, with a challenging tax and fee regime it requires a very-cost effective operation in order to be commercially viable. It should definitely be looked upon in conjunction with the NJ market, as like NY there is quite a lot of population commuting, especially in south Jersey.

PA is definitely a potential big online market, being only one of a handful of states to offer both sports betting and iGaming. However, with a challenging tax and fee regime it requires a very-cost effective operation in order to be commercially viable. It should definitely be looked upon in conjunction with the NJ market, as like NY there is quite a lot of population commuting, especially in south Jersey.

The latest DoJ developments also have potential implications on poker, so we’re monitoring these carefully as we formulate our plans for the next states in line. No firm timeline for PA yet, but we’re working with our partners at Caesars in order to bring WSOP into PA as soon as we can. Cross sale is also an important element in any future PA play.

How do you see poker fitting into your cross-sell strategy?

Much like sport, poker is typically a lower CPA product, hence it is vital in order to create a sustainable ROI on our marketing dollars, especially in the higher tax brackets. PA for example has 54% tax on slots and 40%+ on sport, but only 14% on poker. In addition, player engagement is always higher when they play across product and platforms.

888 began the rollout of its new online poker platform Poker 8 in March. Can you give us an update on how the new software has been received by players and what updates can be expected in the coming months?

The new table has been very well received by the players, we’re in constant dialogue with them in order to create the best possible poker experience out there. We will now continue to develop and deploy the other components, as well deploying Poker8 in additional jurisdictions.

For online poker in the US, 888 currently benefits from shared liquidity between states. How does 888 plan to maintain and expand that competitive advantage as more states add online poker and more operators can have multi-state liquidity pools?

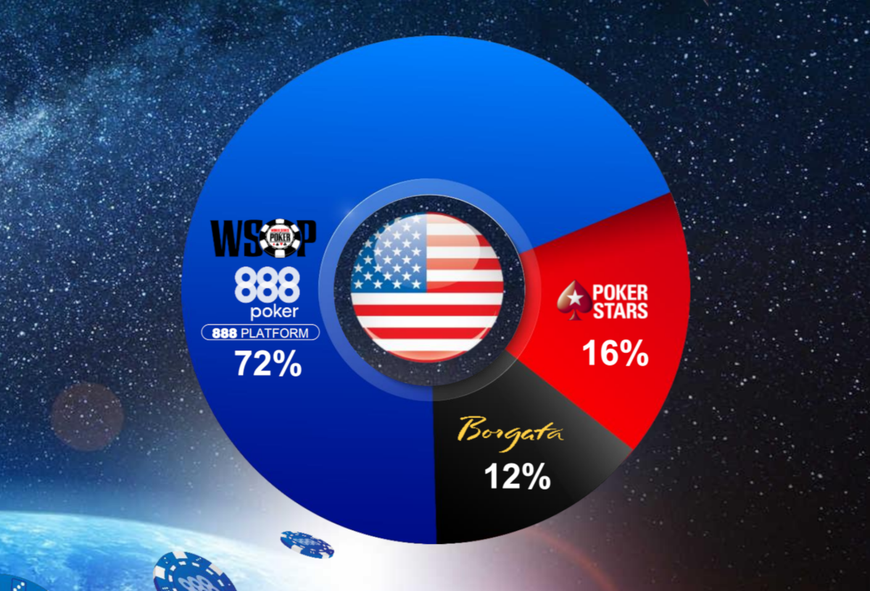

The 888 platform and network indeed has meaningful pole position with our partners at WSOP and the Delaware Lottery. Our main goal is to help states who legalize online poker join the existing compact and network, as liquidity is the key component to any poker product. We also hope and work to have poker follow suit sport legislation, as we see it complementing the sports betting experience as a social entertaining game.

You mention offering poker in PA in conjunction with your current partner WSOP.com. Does 888 plan to continue a B2C poker strategy in the US or will it primarily be B2B moving forward?

We’ll continue to pursue both lines of business, our partners at WSOP have had great success over the years and I think it is a symbiotic relationship as they enjoy many features and content that has been developed for 888poker globally. 888poker is also the exclusive online partner of the WSOP main tournament over the past four years.

What can you tell us about how 888 plans to balance its marketing of the 888poker brand and the All American Poker Network?

We’ve bought out our AAPN JV partners (Avenue Capital) last December, and now own 100% of our B2C vessel. 888poker and AAPN are now effectively the same thing.

888 saw poker revenue decline throughout 2018 and the trend has continued into 2019. How does the company plan to turn this around?

Global poker has suffered fragmented liquidity and local territorial issues over the past 2 years. As one of the top 3 global networks, we are great believers in poker and as such we’ve put our know how and technology to work. We’re already seeing signs of stabilization, and work to put poker back on a growth path. Our recent launch of 888poker in Portugal, which joined our European shared network with 888poker Spain, had an immediate positive effect. We aim to deploy in additional European countries in 2020, offering more liquidity and coupled with the Poker8 product push we’re looking to offer players the ultimate recreational poker destination.

What additional European countries can we expect to see 888 enter in 2020?

We’re currently looking into France for 2020, which will require the relevant internal and regulatory approvals.

Marketing for online poker is concentrated in a few areas including brand ambassadors, live streaming and promotion at live events. What is 888’s view of the effectiveness of those marketing vehicles, and are there plans to expand efforts in any of those areas?

We are a well-diversified marketing outfit, and we’ve indeed been very active on the events and sponsorships front, alongside our online competency. We’re the exclusive online sponsor for WSOP over the past few years, and recently ran our 888poker tournament in Sochi, Russia. As a marketing philosophy, we’re aiming for 360 campaigns that use social, physical and online assets to reach the broadest player base possible. Events and brand ambassadors have been a cornerstone in this strategy that brought 888poker to its current statute.

Will we see any new 888 brand ambassadors in those European countries or perhaps even in the US?

Of course, brand ambassadors are an inherent part of our marketing strategy. We’re constantly evaluating opportunities and to associate 888 with the leading talents in different markets.