PokerStars is set to exit another market—this time, Poland—at the end of this month.

It is yet another in a string of market withdrawals over the last few years. Each time it is another hit to international traffic. The affects of Poland will noticeable, it raises the question whether the operator will be forced to drop guarantees for next month’s SCOOP 2025.

By March 27, PokerStars will completely leave the market. Polish players will no longer be able to play on the site. In a statement released on Tuesday, the company clarified that the exit was not because of any changes in local regulations, “but rather a reassessment of priorities across the Group.”

Since 2020, the operator has withdrawn from several grey markets, which has resulted in smaller playing fields. In the last few years, it has exited Russia, the Netherlands, Norway, the Czech Republic, and several Asian countries—collectively making up a substantial portion of the player base.

Poland is another example of this trend and it will have a noticeable impact on traffic. And there could be more market exits later this year.

From 1st to 3rd

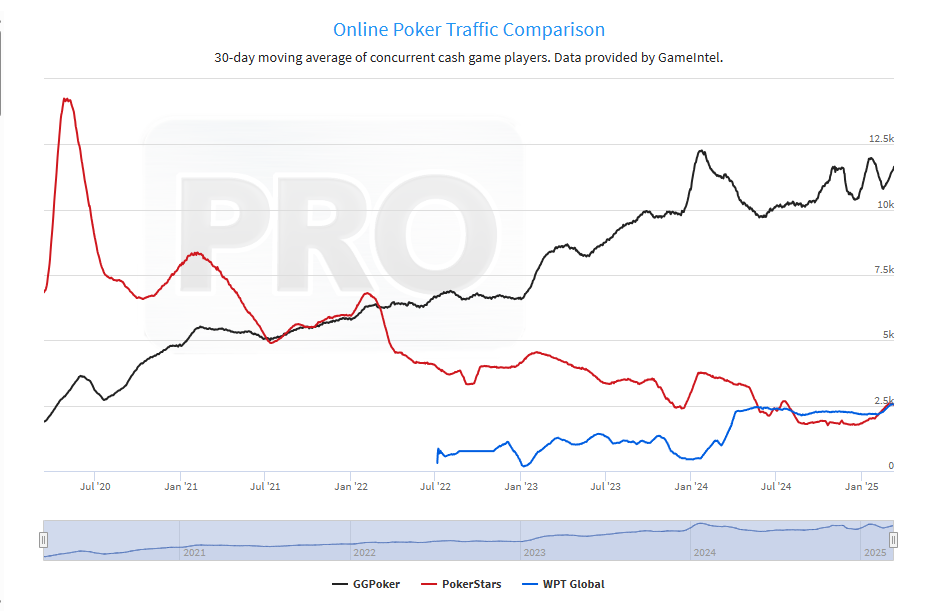

For many years, PokerStars was the dominant force in online poker. However, increased competition and exits from many countries have caused it to lose its position as the world’s largest online poker room. In fact, right now it sits in third, behind GGPoker and WPT Global.

In response, PokerStars has been streamlining its game offerings, removing less popular options to boost liquidity. Tournament guarantees have also been reduced.

Take the upcoming Sunday Million anniversary edition. A few years ago, the anniversary edition boasted a $10 million guarantee, and during the Covid year, that guarantee even rose to $12.5 million. Now, the guarantee is shrinking: Last year, it was $7.5 million, and for this year’s edition, to be held on April 6, it has dropped to $6 million.

Poland, with its 38 million population, is a big market for online poker. Last week’s Sunday Million attracted 10,060 entries, with 290 of those coming from Polish players—almost 3% of the field. In smaller tournaments, Polish players typically make up around 4% to 5% of entries.

With PokerStars set to exit Poland at the end of this month, Polish players will be unable to participate in this year’s Sunday Million anniversary edition.

Will SCOOP 2025 See a Drop in Guarantees?

The bigger question, though, is what will happen to SCOOP. While the dates for this year’s event haven’t been announced yet, SCOOP 2025 will mark its 17th edition. In recent years, SCOOP’s growth has stalled, and the $75 million guarantee has remained unchanged for the last three editions.

Now that we know Polish players won’t be able to take part in this year’s series, that’s up to 5% of the player base gone. The question is whether PokerStars will be able to maintain the $75 million guarantee or if it will need to lower it to $70 million or less.

One possible strategy to maintain the overall series guarantee is to increase the number of tournaments, which is what it has been doing in recent years. However, while the guarantees remain, the average guarantee per tournament has been declining.

This approach could be applied again this year, but it’s expected that guarantees for individual tournaments—including the Main Events—will be reduced.

Another good example is the weekly Sunday Million, a tournament where PokerStars has struggled to avoid overlay. With a $1 million guarantee and a shrinking player pool, it has become increasingly challenging. The operator has tried various strategies to maintain the guarantee, including offering hundreds of thousands of Power Path tickets, experimenting with new formats like Mystery Bounty, Phased (multi-flight day 1s), and running the tournament as part of a series. While some of these efforts have been successful, many weeks have still seen shortfalls.

Challenging Time Ahead

It is undeniably a challenging time for PokerStars, but regulatory changes have forced PokerStars to adapt. While the exit from Poland isn’t tied directly to a recent development in Poland, it stems from the parent company’s decision to focus on regulated and promising markets.

Maintaining real money online poker operations in Poland is increasingly hard to justify. The country’s regulation only licenses the state gambling monopoly for online casino and poker games. Recent hopes for an open regulatory framework for online poker have gone nowhere. With no obvious path towards a local license, PokerStars feels it has to shut its operations there.

This approach mirrors that of PartyPoker (Entain) and now Unibet (FDJ United), which have followed similar paths and recently exited Poland. 888 hasn’t served Polish players since 2017.

Polish players now have a limited choice of operators, with GGPoker and WPT Global the two main sites still serving the market. Neither is owned by a publicly-traded company. Both GGPoker and WPT Global operate in many grey markets and will feel no obligation to exit.

As PokerStars falls to third, these private-traded competitors appear poised to capitalize on markets PokerStars can no longer serve. For Polish players, options now narrow to operators willing to continue in unregulated markets—a pattern that may repeat as PokerStars potentially exits additional territories later this year.