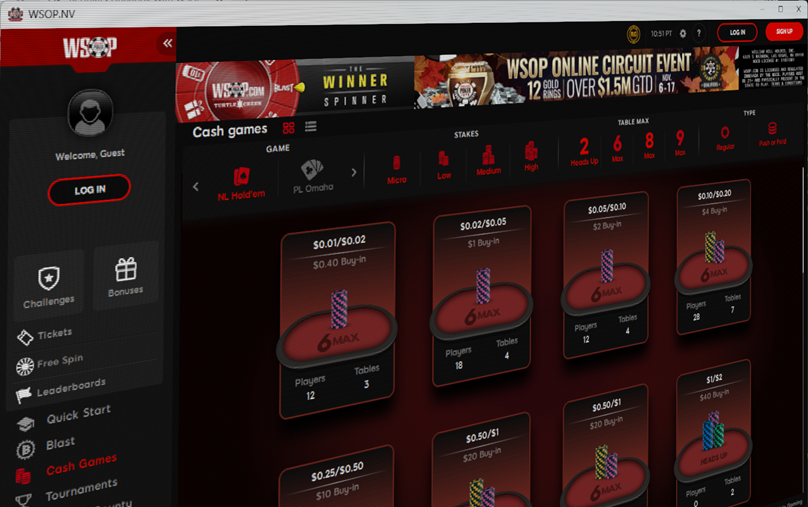

WSOP Online has quietly lowered the minimum buy-in for cash games from the usual 40 big blinds (bbs) to 20.

This change, which took effect on Tuesday, November 12, is now in place across all four US states where WSOP operates, including the shared liquidity network of New Jersey, Nevada, and Michigan, as well as the ring-fenced Pennsylvania market.

The adjustment applies to all stakes in both No-Limit Hold’em and Pot-Limit Omaha games, with one exception: Pot-Limit Omaha Hi/Lo, which retains the old 40 bb minimum buy-in requirement.

- Up to $100 in free play with first deposit*

- Top-quality software

- Compete for WSOP bracelets & rings

While the minimum buy-in has been reduced to 20 bbs, players can still enter these cash games with anywhere from 20 to 100 bbs. Typically, the minimum buy-in is set at 40 big blinds, which is the standard across most poker rooms, both online and live, with a maximum of 100 big blinds. In deepstack games, however, maximum buy-ins can go as high as 250 big blinds or more.

Cash game tables with a lower buy-in requirement are generally easier to play, as players face fewer complex decisions—typically choosing to go all-in or fold pre-flop. This short-stack format appeals to recreational players, as it minimizes post-flop play.

Also, by lowering the minimum buy-in, casual players can also try higher stakes that they might usually avoid. For example, in a $5/$10 cash game with a 20 bb minimum buy-in, a player only needs $200 to enter. If the minimum were set at 40 bbs, they would need $400 to join. This approach allows players to enjoy higher-stakes games without risking large sums on one hand.

WSOP’s decision to lower the minimum buy-in appears to be aimed at accommodating recreational players.

Buy-In Variations Across Different US Platforms

Different online poker rooms in the US market have varying buy-in requirements. For example, BetMGM Poker typically sets the minimum buy-in at 30 big blinds for most stakes, with exceptions at $0.02/$0.05 for FastForward (its FastFold variant) and $25/$50, where the minimum is set at 20 big blinds.

PokerStars, by contrast, maintains a standard minimum buy-in of 40 big blinds across all stakes.

The recently launched BetRivers Poker in Pennsylvania, however, requires a fixed 100 big blind buy-in, following the model of its predecessor, Run It Once Poker. This fixed buy-in is partly designed to “force bankroll management” for both recreational and professional players.

The mandatory 100 big blind buy-in is likely to encourage players to stick to lower stakes, potentially increasing the lifetime of a player. However, this could also impact the availability and frequency of mid- and high-stakes games.

In the global dot-com market, GGPoker is among the few sites that have set the minimum buy-in requirement at 20 big blinds.

| Operator | Min Buy-in | Max Buy-in (BBs) |

|---|---|---|

| WSOP Online | 20 BB | 100 BB |

| PokerStars USA | 40 BB | 100 BB |

| BetMGM Poker US | 20 – 30 BB | 100 BB |

| BetRivers Poker PA | 100 BB | 100 BB |

Players’ Reactions

As expected, the decision to make cash games even more short-stacked has not been well-received by regular players. One player questioned whether this change was meant to increase traffic, calling it “horrible,” while another mentioned they would take their action to a different site.

Short-stacked games do come with downsides. Many argue that by reducing stack sizes, the skill and depth of traditional deep-stacked poker are compromised, diminishing the enjoyment for experienced players.

Although professional poker players often criticize these simplified formats for taking skill out of the game, this approach is in line with the industry’s trend toward offering mobile-friendly, straightforward games. Formats like lottery sit-and-go’s, bounty-infused sit-and-go’s, short-stacked progressive knockout tournaments, and All-In or Fold sit and go’s all follow this trend.

How this change will affect WSOP’s cash game ecosystem and player traffic is yet to be seen. Currently, WSOP’s shared liquidity network averages around 130 occupied cash game seats, trailing behind BetMGM’s newly launched shared network, which has over 270 seats, and PokerStars’ MI-NJ player pool, which averages close to 180 seats.