GVC highlighted it’s online poker vertical as the biggest growing segment in its business with net gaming revenue up 32% on a constant currency basis, the company stated.

“A combination of factors are behind the impressive growth including product development, increased marketing, localized market focus and improved player experience,” stated GVC’s Chief Executive Kenneth Alexander in presenting the company’s financial results for H1 2017.

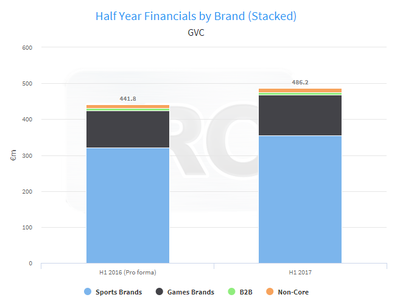

The company does not separate online poker revenue from other games in its financial reports. Overall, the “games brands” segment—which includes partypoker, Party Casino, Casino Club, Gioco Digitale, and Foxy Bingo—contributed €112.4 million in net gaming revenue for the first half of 2017, an increase of 8%, or 10% on a constant currency basis.

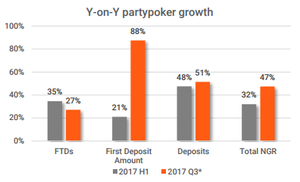

Still, the company did, for the first time, highlight some relative metrics in poker to emphasize the vertical’s growth. First-time deposits were up 35% year-on-year; first deposit amounts rose 21% and deposits grew 48%.

Still, the company did, for the first time, highlight some relative metrics in poker to emphasize the vertical’s growth. First-time deposits were up 35% year-on-year; first deposit amounts rose 21% and deposits grew 48%.

“From a contribution perspective, we expect to see the benefits of the increased investment in partypoker to come through in the second half of the current year and beyond,” said Alexander.

According to the slides, this growth has continued into Q3, with the company reporting 47% year-on-year growth in net gaming revenue so far this quarter.

The “sports brands” segment of the business, which includes the global bwin and sportingbet brands, is still the company’s dominant B2C revenue stream. In the first half of 2017, net gaming revenue for the division grew to €355.1 million, an increase of 10.8%, or 13% by constant currency.

Overall, the sports division maintained their share of total group revenue at 73%, which totaled €486.2 million for H1 2017.

Overall, the sports division maintained their share of total group revenue at 73%, which totaled €486.2 million for H1 2017.

“I am delighted with the strong progress across the group, which has continued to exceed our expectations since last year’s acquisition of bwin.party,” stated Alexander. “A combination of high-quality talent, proprietary technology, and proven brands are key components driving the business forward.”

The company has been investing heavily in online poker since it took over the helm from bwin.party in early 2016. It has revamped the loyalty program, improved software, hired dozens of new ambassadors and rejuvination its live tournament presence with great early success.

Thanks to these changes, cash game traffic has hit a two year high and is expected to overtake 888poker to take second place in the European dot-com online poker market soon.

This article originally appeared on Poker Industry PRO and has been republished here as a courtesy to our readers. Please visit Poker Industry PRO for more information on the industry intelligence services that are available, or email sales@pokerindustrypro.com to get a free trial.